1,471 Riverside County, CA Commercial Real Estate Listings

-

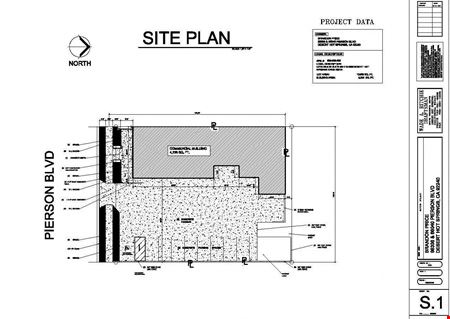

66038 - 66040 Pierson Blvd, Desert Hot Springs, CAProperty

66038 - 66040 Pierson Blvd, Desert Hot Springs, CAProperty- Retail

- 4,338 SF

Year Built- 1950

For Sale- $650,700

-

8816 Limonite Ave, Jurupa Valley, CAProperty

8816 Limonite Ave, Jurupa Valley, CAProperty- Retail

- 2,250 SF

For Sale- $1,300,000

-

41636 Enterprise Circle N, Temecula, CAProperty

41636 Enterprise Circle N, Temecula, CAProperty- Industrial

- 3,564 SF

Availability- 1 Space

- 3,564 SF

For Lease- $5,200.00/MO

-

0 Date Street, Murrieta, CAProperty

0 Date Street, Murrieta, CAProperty- VacantLand

For Sale- $949,000

-

1550 Magnolia Avenue, Corona, CAProperty

1550 Magnolia Avenue, Corona, CAProperty- Industrial

- 198,800 SF

Availability- 1 Space

- 39,431 SF

Year Built- 2002

For Lease- $1.39/SF/MO

-

3840-3848 McKinley Street, Corona, CAProperty

3840-3848 McKinley Street, Corona, CAProperty- Retail

- 19,773 SF

Availability- 3 Spaces

- 4,260 SF

Year Built- 1980

For Lease- $1.80/SF/MO

-

NE Corner of Vine St and 15th St, Eastside Riverside, Riverside, CAProperty

NE Corner of Vine St and 15th St, Eastside Riverside, Riverside, CAProperty- VacantLand

For Sale- $1,800,000

-

890 West Stetson Avenue, Hemet, CAProperty

890 West Stetson Avenue, Hemet, CAProperty- Office

- 12,600 SF

Availability- 1 Space

- 12,600 SF

For Lease- $1.25/SF/MO

-

NWC Hwy 60 & Hwy 91/215, Northside Riverside, Riverside, CA

NWC Hwy 60 & Hwy 91/215, Northside Riverside, Riverside, CA -

-

-

31951 Corydon Rd, Lake Elsinore, CAProperty

31951 Corydon Rd, Lake Elsinore, CAProperty- Industrial

- 1,452 SF

Availability- 1 Space

- 1,452 SF

For Lease- $1.60/SF/MO

-

6160 Arlington Avenue, Ramona Riverside, Riverside, CAProperty

6160 Arlington Avenue, Ramona Riverside, Riverside, CAProperty- Retail

- 60,558 SF

Availability- 5 Spaces

- 36,124 SF

Year Built- 1972

For Lease- $1.35 - $1.70/SF/MO

-

8816 Limonite Ave, Jurupa Valley, CA

8816 Limonite Ave, Jurupa Valley, CA -

39400 Murrieta Hot Springs Road, Murrieta, CAProperty

39400 Murrieta Hot Springs Road, Murrieta, CAProperty- Retail

- 120,000 SF

Availability- 1 Space

- 3,595 SF

Year Built- 2005

For Lease- $1.50/SF/MO

-

1410 3rd Street, University, Riverside, CAProperty

1410 3rd Street, University, Riverside, CAProperty- Office

- 68,897 SF

Availability- 4 Spaces

- 4,360 SF

Year Built- 1987

For Lease- $1.25 - $1.30/SF/MO

-

27555 Ynez Road #110, Temecula, CA

27555 Ynez Road #110, Temecula, CA27555 Ynez Road

Coworking ConnectionServices- Virtual Office

- Open Workspace

- Meeting Room

- Private Office

- Dedicated Desk

Amenities -

1290 Hamner Avenue, Norco, CAProperty

1290 Hamner Avenue, Norco, CAProperty- Retail

- 128,345 SF

Availability- 5 Spaces

- 7,701 SF

Year Built- 1995

For Lease Contact for pricing -

2553 Sampson Ave, Corona, CA

2553 Sampson Ave, Corona, CA -

3600 Redlands Ave, Perris, CA

3600 Redlands Ave, Perris, CA -

43214 Blackdeer Loop, Temecula, CAProperty

43214 Blackdeer Loop, Temecula, CAProperty- Industrial

- 48,690 SF

Availability- 1 Space

- 4,224 SF

Year Built- 1989

For Lease- $5,490.00/MO

-

12660 Day Street, Moreno Valley, CAProperty

12660 Day Street, Moreno Valley, CAProperty- Sport / Entertainment

- 2,378 SF

Availability Contact for availabilityYear Built- 2015

For Lease Contact for pricing -

42580 Caroline Ct, Palm Desert, CAProperty

42580 Caroline Ct, Palm Desert, CAProperty- Office

- 6,000 SF

Availability- 2 Spaces

- 4,083 SF

Year Built- 1993

For Lease- $1,685.00 - $4,850.00/MO

-

4160 Temescal Canyon Road, Corona, CA

4160 Temescal Canyon Road, Corona, CATailoredSpace Corona

TailoredSpaceServices- Virtual Office

- Meeting Room

- Private Office

- Dedicated Desk

Amenities -

3355 Iowa Avenue, University, Riverside, CAProperty

3355 Iowa Avenue, University, Riverside, CAProperty- Retail

- 35,374 SF

Availability- 1 Space

- 2,400 SF

Year Built- 1987

For Lease- $1.50/SF/MO

Other Popular Searches

-

991 listings

-

207 listings

-

181 listings

-

163 listings

-

156 listings

-

131 listings

-

129 listings

-

129 listings

-

114 listings

-

95 listings