457 Miami, FL Office Spaces for Rent

-

730 Northwest 107th Avenue 2nd Floor, Miami, FL

730 Northwest 107th Avenue 2nd Floor, Miami, FLFL, Miami - NW 107th Ave

RegusServices- Virtual Office

- Open Workspace

- Private Office

- Dedicated Desk

Amenities -

11900 Biscayne Boulevard, Miami, FLServices

11900 Biscayne Boulevard, Miami, FLServices- Virtual Office

- Open Workspace

- Private Office

- Dedicated Desk

Amenities -

9100 South Dadeland Blvd. Suite 1500, Miami, FL

9100 South Dadeland Blvd. Suite 1500, Miami, FLDadeland

RegusServices- Virtual Office

- Open Workspace

- Private Office

- Dedicated Desk

Amenities -

_Miami_USA_BusinessLounge.jpg?width=450) 333 Southeast 2nd Avenue #2000, Miami, FL

333 Southeast 2nd Avenue #2000, Miami, FLWells Fargo Plaza

RegusServices- Virtual Office

- Open Workspace

- Private Office

- Dedicated Desk

Amenities -

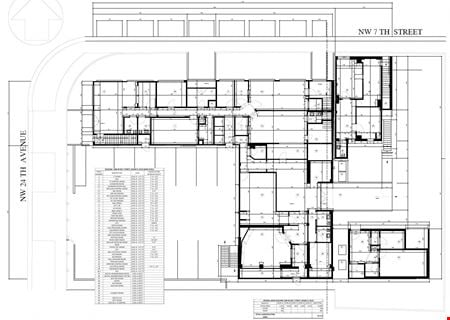

1951 NW 7th Avenue, Allapattah, Miami, FLProperty

1951 NW 7th Avenue, Allapattah, Miami, FLProperty- Office

- 258,681 SF

Availability- 1 Space

- 38,393 SF

Year Built- 2011

For Lease- $45.00/SF/YR

-

9000, 9010 & 9020 SW 137th Ave, Kings Meadow - Parkside Glen, Miami, FLProperty

9000, 9010 & 9020 SW 137th Ave, Kings Meadow - Parkside Glen, Miami, FLProperty- Office

- 138,464 SF

Availability- 2 Spaces

- 3,543 SF

Year Built- 1985

For Lease- $23.00 - $25.00/SF/YR

-

1221 Brickell Avenue, Brickell, Miami, FLProperty

1221 Brickell Avenue, Brickell, Miami, FLProperty- Office

- 408,597 SF

Availability- 1 Space

- 3,967 SF

Year Built- 1986

For Lease Contact for pricing -

13590 SW 134th Ave Suite 205, Three Lakes, Miami, FLProperty

13590 SW 134th Ave Suite 205, Three Lakes, Miami, FLProperty- Office

- 1,361 SF

Availability Contact for availabilityYear Built- 2006

For Lease Contact for pricing -

501 Brickell Key Drive, Brickell Key, Miami, FLProperty

501 Brickell Key Drive, Brickell Key, Miami, FLProperty- Office

- 97,087 SF

Availability- 1 Space

- 6,337 SF

Year Built- 1986

For Lease Contact for pricing -

101 NW 8th Street, Overtown, Miami, FLProperty

101 NW 8th Street, Overtown, Miami, FLProperty- Office

- 55,000 SF

Availability- 3 Spaces

- 4,137 SF

Year Built- 2019

For Lease- $3,750.00 - $13,500.00/MO

-

11077 Biscayne Boulevard, Miami Shores, Miami, FLProperty

11077 Biscayne Boulevard, Miami Shores, Miami, FLProperty- Office

- 25,000 SF

Availability- 1 Space

- 683 SF

Year Built- 1984

For Lease- $22.00 - $23.00/SF/YR

-

2000 South Dixie Hwy, Northeast Coconut Grove, Miami, FLProperty

2000 South Dixie Hwy, Northeast Coconut Grove, Miami, FLProperty- Office

- 54,000 SF

Availability- 1 Space

- 16,000 SF

Year Built- 1972

For Lease- $34.00 - $40.00/SF/YR

-

1600 NW 20 ST, Allapattah, Miami, FLProperty

1600 NW 20 ST, Allapattah, Miami, FLProperty- Office

- 12,510 SF

Availability- 1 Space

- 1,522 SF

Year Built- 1973

For Lease- $20.00/SF/YR

-

1728 Coral Way, Silver Bluff, Miami, FLProperty

1728 Coral Way, Silver Bluff, Miami, FLProperty- Office

- 87,156 SF

Availability- 2 Spaces

- 3,150 SF

Year Built- 2010

For Lease- $42.00/SF/YR

-

2380-2390 NW 7th St, Little Havana, Miami, FLProperty

2380-2390 NW 7th St, Little Havana, Miami, FLProperty- Office

- 14,112 SF

Availability- 1 Space

- 14,112 SF

Year Built- 1930

For Lease- $44.00/SF/YR

-

9200 South Dadeland Blvd, Downtown Dadeland, Miami, FLProperty

9200 South Dadeland Blvd, Downtown Dadeland, Miami, FLProperty- Office

- 245,964 SF

Availability- 7 Spaces

- 9,624 SF

Year Built- 1972

For Lease- $38.00/SF/YR

-

111 Northeast 1st Street 8th Floor, Miami, FL

111 Northeast 1st Street 8th Floor, Miami, FL111 Northeast 1st Street

mindwarehouseServices- Virtual Office

- Meeting Room

- Private Office

Amenities -

600 Brickell Avenue, Brickell, Miami, FLProperty

600 Brickell Avenue, Brickell, Miami, FLProperty- Office

- 614,905 SF

Availability- 1 Space

- 2,613 SF

Year Built- 2011

For Lease Contact for pricing -

201 South Biscayne Blvd, Downtown Miami, Miami, FLProperty

201 South Biscayne Blvd, Downtown Miami, Miami, FLProperty- Office

- 803,005 SF

Availability- 18 Spaces

- 226,689 SF

Year Built- 1983

For Lease Contact for pricing -

1100 Brickell Bay Dr, Brickell, Miami, FL

1100 Brickell Bay Dr, Brickell, Miami, FL -

444 Brickell Ave, Brickell, Miami, FLProperty

444 Brickell Ave, Brickell, Miami, FLProperty- Office

- 200,368 SF

Availability- 1 Space

- 7,075 SF

Year Built- 1973

For Lease Contact for pricing -

2433 NW 7 ST, Little Havana, Miami, FLProperty

2433 NW 7 ST, Little Havana, Miami, FLProperty- Office

- 13,933 SF

Availability- 1 Space

- 12,933 SF

Year Built- 1973

For Lease- $35.00/SF/YR

-

11921 SW 144th Street, Three Lakes, Miami, FLProperty

11921 SW 144th Street, Three Lakes, Miami, FLProperty- Industrial

- 32,919 SF

Availability- 1 Space

- 6,221 SF

Year Built- 1984

For Lease Contact for pricing -

3050 Biscayne Blvd, Midtown - Edgewater, Miami, FLProperty

3050 Biscayne Blvd, Midtown - Edgewater, Miami, FLProperty- Office

- 89,000 SF

Availability- 2 Spaces

- 4,373 SF

Year Built- 1972

For Lease- $35.00/SF/YR

-

.jpg?width=450) 168 SE 1st St #10, Downtown Miami, Miami, FLProperty

168 SE 1st St #10, Downtown Miami, Miami, FLProperty- Office

- 6,344 SF

Availability Contact for availabilityYear Built- 1925

For Lease Contact for pricing

Miami, FL Office Space Listings Data

Other Popular Searches

-

113 listings

-

73 listings

-

65 listings

-

58 listings

-

33 listings

-

33 listings

-

22 listings

-

20 listings

-

18 listings

-

17 listings

-

502 listings

-

238 listings

-

159 listings

-

156 listings

-

119 listings

-

109 listings

-

75 listings

-

71 listings

-

63 listings

-

52 listings