278 Riverside County, CA Retail Spaces for Lease

-

77-750 to 77-780 Country Club Dr., Palm Desert, CAProperty

77-750 to 77-780 Country Club Dr., Palm Desert, CAProperty- Retail

- 23,000 SF

Availability- 1 Space

- 1,100 SF

For Lease- $1.65/SF/YR

-

25425 Jefferson Avenue, Murrieta, CAProperty

25425 Jefferson Avenue, Murrieta, CAProperty- Retail

- 10,060 SF

Availability- 1 Space

- 2,800 SF

For Lease- $1.85/SF/MO

-

72990 El Paseo, Palm Desert, CAProperty

72990 El Paseo, Palm Desert, CAProperty- Retail

- 9,600 SF

Availability- 1 Space

- 1,508 SF

For Lease- $2.00/SF/MO

-

1480 East Florida Avenue, Hemet, CAProperty

1480 East Florida Avenue, Hemet, CAProperty- Retail

- 102,000 SF

Availability- 4 Spaces

- 15,385 SF

Year Built- 1966

For Lease- $1.50 - $2.50/SF/MO

-

40675 Murrieta Hot Springs Road, Murrieta, CAProperty

40675 Murrieta Hot Springs Road, Murrieta, CAProperty- Retail

- 45,844 SF

Availability- 1 Space

- 909 SF

For Lease- $2.50/SF/MO

-

74-895 Thru 74-985 Highway 111, Indian Wells, CAProperty

74-895 Thru 74-985 Highway 111, Indian Wells, CAProperty- Retail

- 105,714 SF

Availability- 4 Spaces

- 5,460 SF

Year Built- 1983

For Lease- $2.30/SF/MO

-

29996-29997 Canyon Hills Rd. & 25341-25346 Railroad Canyon Rd., Lake Elsinore, CA

29996-29997 Canyon Hills Rd. & 25341-25346 Railroad Canyon Rd., Lake Elsinore, CA -

31712-31724 Casino Drive, Lake Elsinore, CA

31712-31724 Casino Drive, Lake Elsinore, CA -

33950 Angels Lane, Wildomar, CAProperty

33950 Angels Lane, Wildomar, CAProperty- Retail

- 10,500 SF

Availability- 1 Space

- 1,403 SF

For Lease- $2.50/SF/MO

-

39413-39621 Los Alamos Road, Murrieta, CAProperty

39413-39621 Los Alamos Road, Murrieta, CAProperty- Retail

- 140,000 SF

Availability- 1 Space

- 2,172 SF

For Lease- $2.25/SF/MO

-

440 S El Cielo Rd, Palm Springs, CAProperty

440 S El Cielo Rd, Palm Springs, CAProperty- Retail

- 21,688 SF

Availability- 1 Space

- 860 SF

Year Built- 1991

For Lease- $2.25/SF/MO

-

39400 Murrieta Hot Springs Road, Murrieta, CAProperty

39400 Murrieta Hot Springs Road, Murrieta, CAProperty- Retail

- 120,000 SF

Availability- 1 Space

- 3,595 SF

Year Built- 2005

For Lease- $1.50/SF/MO

-

300 South Highland Springs Avenue, Banning, CAProperty

300 South Highland Springs Avenue, Banning, CAProperty- Retail

- 47,387 SF

Availability- 4 Spaces

- 9,562 SF

Year Built- 1990

For Lease- $1.70 - $1.80/SF/MO

-

25260-25270 Madison Ave, Murrieta, CAProperty

25260-25270 Madison Ave, Murrieta, CAProperty- Retail

- 25,200 SF

Availability- 1 Space

- 21,000 SF

Year Built- 1993

For Lease Contact for pricing -

10281 Magnolia Avenue, La Sierra, Riverside, CAProperty

10281 Magnolia Avenue, La Sierra, Riverside, CAProperty- Retail

- 53,484 SF

Availability- 1 Space

- 1,800 SF

Year Built- 1977

For Lease Contact for pricing -

44419 - 44491 Town Center Way , Palm Desert, CA

44419 - 44491 Town Center Way , Palm Desert, CA -

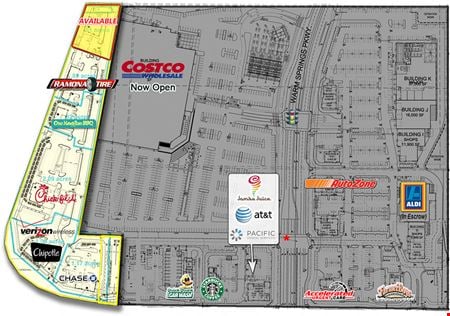

NEC I-215 and Clinton Keith Road, Murrieta, CA

NEC I-215 and Clinton Keith Road, Murrieta, CA -

41539 Kalmia Street, Murrieta, CAProperty

41539 Kalmia Street, Murrieta, CAProperty- Retail

- 36,400 SF

Availability- 1 Space

- 1,856 SF

Year Built- 2007

For Lease- $2.00/SF/MO

-

140 Hidden Valley Pky, Suite F, Norco, CAProperty

140 Hidden Valley Pky, Suite F, Norco, CAProperty- Retail

- 24,245 SF

Availability- 1 Space

- 1,577 SF

Year Built- 2005

For Lease Contact for pricing -

39360 Los Alamos Road & Whitewood Road, Murrieta, CA

39360 Los Alamos Road & Whitewood Road, Murrieta, CA -

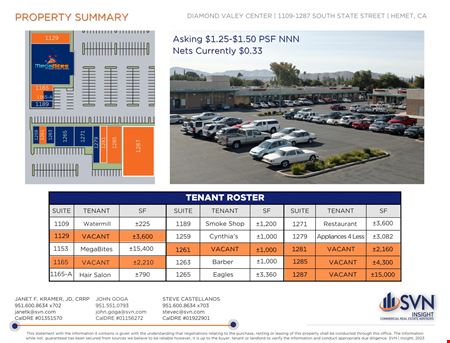

1109-1287 South State Street, Hemet, CAProperty

1109-1287 South State Street, Hemet, CAProperty- Retail

- 68,034 SF

Availability- 5 Spaces

- 25,972 SF

For Lease- $1.25 - $1.50/SF/MO

-

8816 Limonite Ave, Jurupa Valley, CA

8816 Limonite Ave, Jurupa Valley, CA -

371 Wilkerson Avenue, Perris, CAProperty

371 Wilkerson Avenue, Perris, CAProperty- Retail

- 84,400 SF

Availability- 2 Spaces

- 11,417 SF

Year Built- 1986

For Lease- $13.80/SF/YR

-

36-891 Thru 36-901 Cook St., Palm Desert, CA

36-891 Thru 36-901 Cook St., Palm Desert, CA -

73111 El Paseo, Palm Desert, CAProperty

73111 El Paseo, Palm Desert, CAProperty- Retail

- 40,204 SF

Availability- 7 Spaces

- 8,164 SF

Year Built- 1980

For Lease- $2.90 - $5.70/SF/MO

Other Popular Searches

-

182 listings

-

36 listings

-

30 listings

-

20 listings

-

19 listings